FIBONACCI – Retracements

FIBONACCI – Retracements

-A Forex Trading

Perspective-

Fibonacci is an analytical tool which was invented in the 13th

century by “Leonardo Pisa”.

In Forex trading, the Fibonacci is

one of key tools that assist traders in determining when is the right time to

buy or sell. It provides traders with reliable information on what the market

has been doing and what it intends doing next – through Retracements as an

example.

In Forex trading, Retracement can be

defined as; price correction (pull-back) during an impulse or larger (up-ward

or down-ward) trend. Retracements are simply price corrections rather than

actual trend reversals.

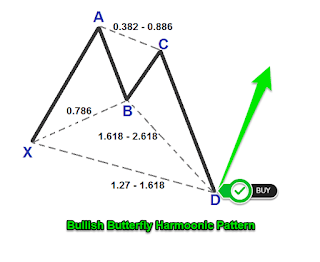

However, as pull backs, Retracements

act as an opportunity for traders to enter trades in their original direction,

but take advantage of better prices during the retracement periods.

Characteristically, a Retracement is

followed by an impulse move which carries on in the original direction.

Therefore, they provide a temporary opportunity for traders to buy at cheaper

price or sell at higher price.

NB:

-The best point to buy is following

a pull-back while the trend continues to rise.

–The best point to sell is

following a pull-back while the trend continues to fall.

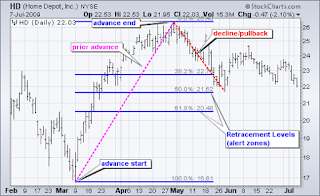

A Fibonacci Zone (Fib-zone)

is an area within Fibonacci, situated at around 50% to 0.618% level. This is

the area where retracements (pull-backs/ price correction) usually end and from

where new impulse moves usually begin.

However, sometimes pull-backs do

slightly fall short or exceed the Fibzone area, for instance where an

impulse-move is too steep (almost vertical in shape) that its correction

/pull-back/retracement is shorter and ending at around 38%, instead of the

normal 50% – 0.61% level.

Similarly, Retracements can go past the

Fibzone, indicating that it is no longer a price correction or pull-back but an

actual change in direction of the trend hence, time to plot a new Fibonacci in

the opposite (now current) direction.

Mind you, Fibonacci can be plotted

during two scenarios or directions: –

1) Down-Up – in an upward

trend/move:

In this case, Fibonacci is

drawn/dragged from the last significant low (swing low) to the most recent high

(swing high).

In other words; it is dragged from

the tip of the recent bottoms to the peak of the recent highs on the chart.

2) Up-Down – in a downward

trend/move:

This is where Fibonacci is dragged

from top to bottom of a trend chart.

In other words; it is drawn from the

peak of recent highs to the bottom of recent lows.

It is equally important to note that

the essence of Fibonacci-Retracement analysis is to measure trend impulses in

relation their pull-backs (retracement), so as to determine if a particular

retracement is just temporary correction or a definite change in direction of

the trend.

But just as is the case with all

other indicators, a trade should not be entered until the outcomes of the

Fibonacci analysis are confirmed by other analytical tools, such as the

appearance of retracement candlesticks (eg. the hammer) on specific points, as

well as confirmations from indicators like RSI (over-bought or over-sold

conditions) and MACD (above or below Zero) among others.

The trader must be able to apply

several analytical tools in order to build a case for entering the market.

And always look at the Structure of

the trend, particularly on the left of the structure for clues! As the popular

saying goes; “Look left! Structures leave Clues!”.

It is widely believed that; markets

trend 30% of the time, and they are in consolidation 70% of the time. Consolidation

is the period when markets move up and down along (within) the same price

levels. This means that those who understand and effectively use their

analytical tools make money during the 70% of market consolidation.

In all, Fibonacci is a key item in

the Forex trader’s tools box, for it informs the trader on what the market is

doing and what it intends to do going forward.

Compare: Fibonacci Retracement with Fibonacci Extension

(Profit Targets).

OJ

Mwale – Sani Global - Forex

Check the links below, you may find

them useful: –

https://tinyurl.com/ycxm8wv2

Comments

Post a Comment