The Butterfly-Harmonic Pattern

The Butterfly-Harmonic Pattern

-Forex

Trader’s Perspective-

As explained in our introduction,

Harmonic Patterns use Fibonacci retracement tool, to enable the trader determine

turning points (trend reversal zones) with nearest accuracy.

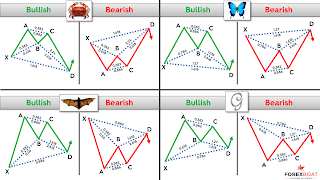

All Harmonic Patterns are shaped in a

zigzag formation, “M” shape depicting an uptrend and a “W” depicting a

downtrend.

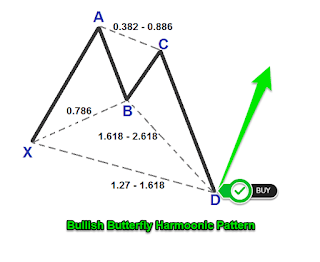

The Butterfly like all Harmonic patterns,

has five points - namely, “XABCD”.

As always, the market will provide the

“XA” leg – being the impulse leg or move. The trader therefore is expected to identify

the remaining “BCD” points.

Therefore, using the Fibonacci retracement

tool, you can measure and identify “BCD” points based on the following

measurement guidelines or Criteria: -

Plot the Fibonacci from peak of to

the lowest point on the chart, then identify: -

1) Point B: Which should be at

around level 78.6, retracement of leg “XA”.

2) Point C: Which should be between

38.2 and 88.6, retracement of leg “AB”.

3) Point D: Which should be between

127.2 and 161.8, *expansion of leg “XA”.

*Expansion refers to a scenario

where; trend line breaks below the support level (Point D).

Note: All

Harmonic Patterns ends/completes at point “D”. This is known as “Point Reversal

Zone”.

Therefore to ascertain completion of

a Harmonic Pattern, you look for trend rejection signs, which are depicted by trend-reversal

signs (a confluence of indicators) including: -

·

Head and Shoulder

· Double top

· Candlestick formation (e.g. the

Engulfing pattern)

·

Stochastic indicator (oversold/overbought)

and MacD indicator (Divergence/Convergence).

NB: Harmonic patterns are better traded on Higher time frames, from H4 going up.

On Stop Loss (SL), rules recommend

that it is placed a few pips below or above point “D”. Therefore, in the Butterfly

pattern, it should be placed above/below level 161.8 – Bearish/Bullish

respectively.

Take Profit (TP) in Harmonic Patterns is realized at the following levels: -

·

First TP is at 38.2

·

Second TP is at 61.8

NB: You measure Take Profit (TP) by plotting

the Fibonacci retracement tool, from the highest point of the impulse wave (i.e.

point “A”), all the way down to the lowest point of the pattern (i.e. point “D”).

Harmonics are very useful patterns

in trading. Most research indicate that they have an accuracy rate of 80%.

It therefore

goes without mentioning that; traders (in Forex or Stock markets) learn, understand and effectively apply these patterns.

OJ

Mwale – Sani Global

Comments

Post a Comment