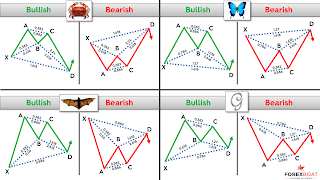

The Gartley - Harmonic Pattern

Harmonic Pattern – The Gartley Harmonic Patterns enable traders to determine turning points with precision and high accuracy. In our introduction to Harmonic Patterns, we indicated that; all Harmonic patterns have five points – namely, “XABCD”. Of the five points, the market always provides “XA” which is the impulse leg/move. Therefore the trader is required to identify the remaining points - “BCD”. The Gartley pattern is the most commonly used harmonic pattern, and it was founded by an American ‘Harold McKinley Hartley’ (H.M. Hartley) in 1932. Like all Harmonic patterns, The Gartley is based on the Fibonacci retracement numbers, and it is used to help traders forecast/identify turning points on the market-trend chart. It is therefore a good indicator on when to enter or exit trades. Using the Fibonacci tool, the Gartley pattern identifies BCD points by using the following measurement Criteria : - >Point ‘B’ is 61.8 retracement of leg “XA”. >Point