Harmonics – The Cypher pattern

-A

Forex Trading Perspective-

Like we have explained in our introduction

to Harmonics -

https://tinyurl.com/y2ghjqkl, Harmonic Patterns enable traders to determine market turning points with precision and high accuracy levels.

https://tinyurl.com/y2ghjqkl, Harmonic Patterns enable traders to determine market turning points with precision and high accuracy levels.

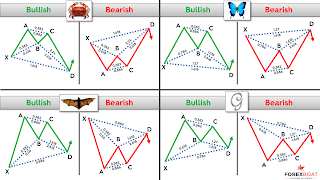

And like all Harmonic Patterns, The Cypher

has five points - namely, “XABCD”. As usual, the market will

always provide “XA” which is the impulse leg/move. The trader is therefore required

to find the remaining points namely; ‘BCD’.

Using the Fibonacci-retracement

tool, you (the trader) measure and identify BCD points using the following

measurement Criteria: -

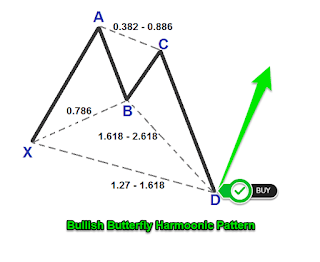

>Point ‘B’ is 38.2 to 61.8

retracement of leg “XA”.

>Point ‘C’ is between 127.2 and 141.4

expansion of leg “AX”.

>Point ‘D’ is 78.6 retracement of

leg “XC”

Important to note that;

Point “D” is referred to as; Potential Reversal

Zone (PRZ).

It

should equally be understood that all legs of the Cypher harmonic pattern

should complete within the measurements, as provided in the criteria above.

Otherwise it cannot be regarded as a valid Cypher harmonic pattern.

It is standard rule in all Harmonic

patterns (the Cypher included) that; Stop

Loss (SL) should be

placed a few pips below point ‘X’.

In as far as profit taking is concerned, first Take Profit (TP) should be placed at point 38.2, and second Take Profit should be placed at 61.8.

It is

also very important that a trader knows; at What

point to place a Trade, Where exactly

to place a Stop loss and When

to Take Profit.

Apparently, the Cypher Harmonic pattern works

well in a calm market, where for instance

breaking news are not centre stage. In this regard, the Cypher could be perfect

pattern for newbie traders.

OJ

Mwale – Sani Global Forex

Images: Courtesy of BabyPips & TradingStrategyGuide

Comments

Post a Comment