The Gartley - Harmonic Pattern

Harmonic

Pattern – The Gartley

Harmonic Patterns enable traders to

determine turning points with precision and high accuracy. In our introduction

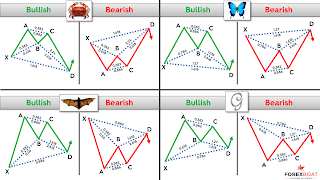

to Harmonic Patterns, we indicated that; all Harmonic patterns have five points

– namely, “XABCD”.

Of the five points, the market

always provides “XA” which is the impulse leg/move. Therefore the trader is

required to identify the remaining points - “BCD”.

The Gartley pattern is the most commonly

used harmonic pattern, and it was founded by an American ‘Harold McKinley

Hartley’ (H.M. Hartley) in 1932.

Like all Harmonic patterns, The Gartley

is based on the Fibonacci retracement numbers, and it is used to help traders forecast/identify

turning points on the market-trend chart. It is therefore a good indicator on

when to enter or exit trades.

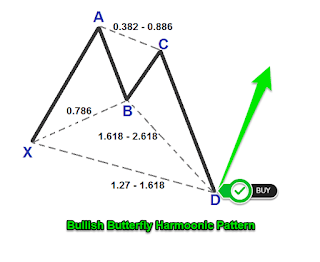

Using the Fibonacci tool, the

Gartley pattern identifies BCD points by using the following measurement Criteria:

-

>Point ‘B’ is 61.8 retracement of

leg “XA”.

>Point ‘C’ is between 38.2 to

88.6 retracement of leg “AB”.

>Point ‘D’ is 78.6 retracement of

leg “XA”.

All harmonic Patterns complete at point "D", this

is the ‘Potential Reversal Zone’ (PRZ).

For the Gartley Harmonic pattern, First

Take Profit (TP) is at 38.2 and second TP is at 61.8. Stop Loss (ST) is

set a few pips below (bullish) or above (bearish) "D". This is the case

with all Harmonic patterns.

Before a decision to enter or exit a

trade is taken, it is highly recommended that such a decision is supported by three

or more other patterns/indicators (a Confluence of indicators thereof), these may include the usual candlestick reversal

pattern, head and shoulders, double bottom, double top, flags, wages, triangles

– etc. Price action analysis is another powerful approaching to

analyzing the market.

As the most used Harmonic Pattern, The

Gartley is a formidable tool that if used correctly can positively turn traders’

fortunes - in a big way.

OJ Mwale – Sani Global

Comments

Post a Comment