Doji Candlesticks

Doji

Candlesticks

-A

Forex Trading Perspective-

Doji candlesticks technically

signify indecision between buyers and sellers in the market. They form

when the opening and closing prices are equal or extremely close to each other.

The Doji often appears at the top or

bottom of a long market trend, which indicates; a pending trend reversal or a pause

before a trend reversal.

Doji candlestick patterns are

created when demand and supply in the market is at the equilibrium. In other

words, where demand (bulls) push prices higher but only to be rejected and

pushed lower by the supply (bears), thereby creating indecision in the market.

Apparently, in Japanese ‘Doji’

means; clunker/clumsy/lost momentum/ “to hesitate”.

Be as it may, we must emphasize

that; the Doji essentially depicts indecision rather than a reversal pattern.

Its usual appearance following significant upward or downward market trends

indicate lost momentum and as such inability by the market to commit either

way.

Doji depicts major turning points in

a given market trend, therefore time for traders to take appropriate actions

like exiting the market or at least scaling back on their positions.

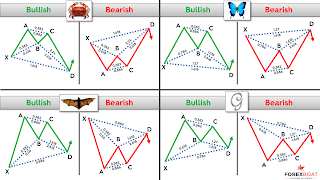

Doji candlesticks come in six

patterns, namely: -

- Doji star candlestick (coming in two types): -

- Morning Doji star - A Bullish Doji star candlestick, which is spotted at the bottom (Support) level of a current trend.

- Evening Doji star - A Bearish Doji star candlestick, which is spotted at the top (Resistance) level of a current trend.

Ref. Diagrams below -

- Long-Legged Doji

- Foul price/Neutral Doji

- Gravestone Doji

- Dragonfly Doji

Full description of each candlestick

pattern and what it essentially entails will be provided in future articles.

However the pictures provided displays actual shapes of the Doji candles.

Be as it may, we should indicate

that; just like the case with any other candlestick, Doji candles equally

provide the four distinct characteristics: -

*Opening Price of a session being

traded.

*Closing Price of a session being

traded.

*Highest price mark of a session

being traded.

*Lowest price mark of a session

being traded.

In all, it is highly advisable that

one deploys a combination of other indicators to confirm pending actions. In

other words, a trade decision (entry or exit) should not be influenced by

candlestick patterns alone, other indicators, knowledge and/or experience must

be applied to confirm decisions before actions are taken.

OJ

Mwale – Sani Global - Forex

Comments

Post a Comment