Harmonics – The Cypher pattern

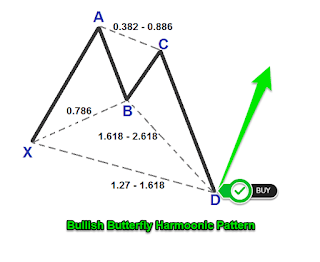

- A Forex Trading Perspective - Like we have explained in our introduction to Harmonics - https://tinyurl.com/y2ghjqkl , Harmonic Patterns enable traders to determine market turning points with precision and high accuracy levels. And like all Harmonic Patterns, The Cypher has five points - namely, “XABCD”. As usual, the market will always provide “XA” which is the impulse leg/move. The trader is therefore required to find the remaining points namely; ‘BCD’. Using the Fibonacci-retracement tool, you (the trader) measure and identify BCD points using the following measurement Criteria : - >Point ‘B’ is 38.2 to 61.8 retracement of leg “XA”. >Point ‘C’ is between 127.2 and 141.4 expansion of leg “AX”. ...