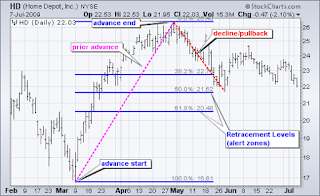

FIBONACCI – Retracements

FIBONACCI – Retracements -A Forex Trading Perspective- Fibonacci is an analytical tool which was invented in the 13th century by “Leonardo Pisa”. In Forex trading, the Fibonacci is one of key tools that assist traders in determining when is the right time to buy or sell. It provides traders with reliable information on what the market has been doing and what it intends doing next – through Retracements as an example . In Forex trading, Retracement can be defined as; price correction (pull-back) during an impulse or larger (up-ward or down-ward) trend. Retracements are simply price corrections rather than actual trend reversals. However, as pull backs, Retracements act as an opportunity for traders to enter trades in their original direction, but take advantage of better prices during the retracement periods. Characteristically, a Retracement is followed by an impulse move which carries on in the original direction. Therefore, they provide a temporary...